E-APP GUIDE

From your portal dashboard, click on "MOBILE BUSINESS TOOLS".

NEXT, click on

"MOBILE APPLICATION".

NEXT, log into your E-App portal.

Your Login ID is your agent number.

Enter your password and then click "LOGIN".

NEXT, click on

"NEW APPLICATION".

-

NEXT, choose the product your client is applying for.

-

NOTE: For this tutorial, we will be using Senior Choice. Senior Choice and Home Protector are the only plans that offer immediate decision with American Amicable. The others may take a few days before rendering an approval decision.

1

2

-

FIRST, choose the resident State for your client.

-

SECOND, click "SUBMIT"

2

3

1

NEXT, click on the check box next to "I confirm"

-

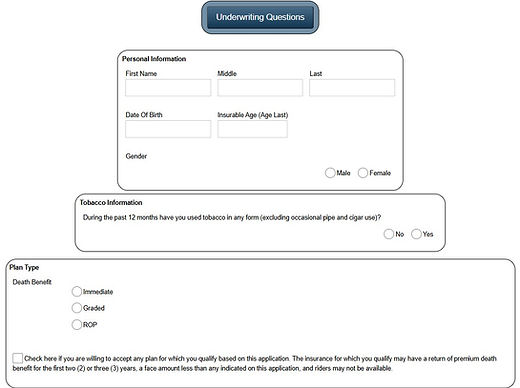

FIRST, fill in all general information and tobacco status.

-

SECOND, choose the plan that the client is applying for. (See Product Info Page for Plan Details)

-

THIRD, it is recommended that you check this box. Checking this box means that if the applicant is applying for the “Immediate” plan for example, and the medical check determines that the applicant actually qualifies for the “Graded” rating instead, American Amicable will approve the application at the "Graded" rating on submission. If NO, then upon medical check, if they determine that the applicant will not qualify for the plan selected, they will decline the application on submission.

-

"Childrens Insurance" allows the insured to add term coverage for their minor children under 18 years of age. Coverage for children expires when they turn 25 years of age. "Grandchild Rider" allows the insured to add term coverage for their minor grandchildren under 16 years of age and expires when they turn 21 years of age. Grandchild must be a minimum of 180 days old.

-

SECOND SECTION: California Eligibility Section. This section asks if the insured has health coverage. If "NO" is selected, the policy will not include the Terminal Illness Rider.

-

THIRD SECTION: Amount of Insurance. Select Payment Mode, Monthly preferred. Then in the "FACE AMOUNT" box, enter the amount of insurance the client is applying for.

-

FIRST, choose if the applicant will want their policy packet digitally sent through email or a physical copy sent in the mail. Select "NO" to receive a physical copy in the mail.

-

SECOND, choose if the applicant will want to elect for the Automatic Premium Loan. This allows the insurer to automatically withdraw funds from the policy's cash value to pay an overdue premium if the policyholder fails to make a payment on time, essentially preventing the policy from lapsing and maintaining coverage without the policyholder needing to take action; this loan is then added to the policy's outstanding loan balance with interest charges applied. If the insured passes away without repaying the loan, their beneficiary will receive the coverage amount minus any outstanding loan amounts.

-

THIRD, on the "Mail Policy to" section, always select either the "Insured" or "Owner".

2

1

3

-

On the next screen, the first section is "Riders and Benefits". (Optional)

-

Nursing Home Waiver of Premium. This rider waives the premiums if the insured is confined to a nursing home for 90 days or more. Premiums must be paid during the 90 day wait period and the nursing home must be recommended by a physician due to the insured's inability to care for himself/herself. This rider is not available in all states.

-

Accidental Death Benefit Rider. Every policy already includes death due to an accident. However, the accidental death benefit rider doubles the coverage amount in case of an accidental death. For example, if a client has $20,000 in base coverage and they pass away of natural causes, their beneficiary will receive $20,000. If they pass due to an accidental death, the beneficiary will receive $40,000.

1

3

2

4

-

"Save Age", is an option that allows you to backdate a policy to a younger age, locking in a lower premium if the effective date is after the applicant's birthday. (Usually not selected)

-

FOURTH, put the date the applicant will want the coverage to start. If the client wants the policy to start immediately, click on the box "Check here for date on approval"

-

FIFTH, click on the "QUOTE" button.

-

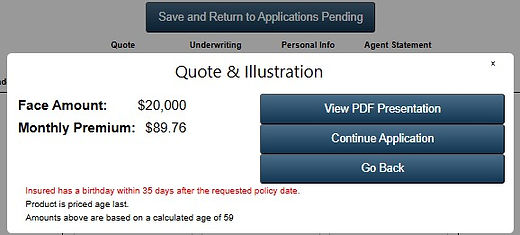

Click "CONTINUE APPLICATION"

-

"View PDF Presentation", button will populate an illustration of the policy showing coverage, cash accumulation, and description of additional riders inlcuded or selected. This is not mandatory.

-

NEXT, complete the health / underwriting questions.

-

"Comments" section can be left blank.

-

Click the "CONTINUE" button.

1

3

2

4

-

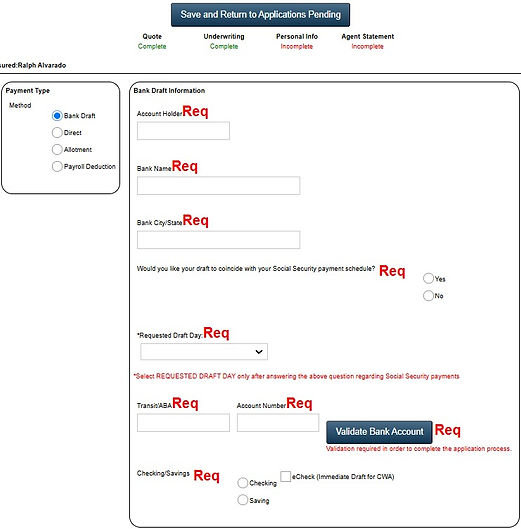

FIRST, select "PAYMENT TYPE". Primary method is Bank Draft.

-

SECOND, enter bank information. On question "Would you like your draft to coincide with your social security payment schedule?", some options may allow the client to draft the reoccuring premium on the day of the month that their social security is deposited. For example, 1st or 3rd, or every second Wednesday of the month. Only select this if it makes sense to do so.

-

NOTE: Direct Bill is when the applicant will receive their bill through mail. This will require them to pay "Quarterly" (3 months of premiums at once every 3 months). DO NOT SELECT ALLOTMENT OR PAYROLL.

-

THIRD, after entering the bank information, click the "VALIDATE BANK ACCOUNT" button then choose "Checking" or "Savings". Do NOT check "eCheck" box.

-

FOURTH, enter all personal information. NOTE: On questions regarding if the Owner and Payor is the same as the insured, to keep it simple, try to keep them the same as insured. But sometimes a child is getting insurance on their parent and will be the owner and the payor while their parent is the insured. In this case the Owner and Payor would be someone else besides the insured.

-

NEXT, enter the primary beneficiary information. "SOCIAL SECURITY NUMBER" and "DATE OF BIRTH" for beneficiary is NOT REQUIRED. If there are more than one beneficiary, the percentage with all combined must equal 100%. For example, if there are two, then the percentage for both should be something like 50/50 or 60/40. If three, 34/33/33. If the beneficiary relationship is "Other", the applicant will need to submit additional information justifying why the beneficiary is someone outside of the selections. Same applies to Contingent. IMPORTANT: Beneficiary must be 18 years of age and over.

-

NOTE: A "Contingent" is a back up beneficiary if the primary cannot receive the death benefit. It is not mandatory and can be added later by the applicant.

-

EXISTING COVERAGE. Answer if the client currently has coverage and if so, if this policy will replace it. An applicant can have coverage somewhere else and still add coverage.

-

Applicant Designee Choice: If the client wants another person notified that their policy is in danger of cancelling, they can do so here.

-

Click the "CONTINUE TO AGENT STATEMENT" button.

-

FIRST, in the "Agent's Electronic Signature" section, type in YOUR name as the agent.

-

SECOND, type in the city that the INSURED is signing and from the drop down, select state the INSURED is signing.

-

THIRD, EXISTING COVERAGE. Answer if the client currently has coverage and if so, if this policy will replace it. An applicant can have coverage somewhere else and still add coverage.

-

If there is an agent commission split, click "SPLIT" and enter the other agent's agent number. Percentage of split must equal 100% combined. For example, 50/50, 60/40, 75/25.

-

FOURTH, click the "CONTINUE TO SIGNATURES" button.

-

NEXT, choose method of signature. TEXT IS PREFERRED for Telesales if possible. Email would be secondary for Telesales. For in-home, use sign on screen.

-

FIRST, re-enter the INSURED'S phone number.

-

SECOND, click the "SEND CODE" button.

E-SIGNATURE GUIDE

"Now [Applicant's Name], I'm going to send you a text message real quick and it will say "YOUR ONE-TIME PASSCODE". I just need that six digit code number please"

-

When the applicant gives you the code number, enter it in the "CODE" box and then click on the "VERIFY" button.

-

NEXT, enter YOUR email and click the "SAVE AGENT EMAIL" button.

-

NEXT, your applicant, will receive a second text with a link. Walk them through the rest of the signature process using the script.

"Now [Applicant's Name], you should get another text with a link that says "PLEASE REVIEW AND SIGN YOUR APPLICATION". Go ahead and click on the blue link starting with "HTTPS" and then let me guide you through the signature process.

A

B

"Now on the next screen, you'll see where it says "LOGIN TO ESIGN". Below that, you'll see where it says to enter the last 4 of your social in the box that has a lock icon next to it. Go ahead and enter your last four and then press on the "LOGIN" button. You may see a screen that says "Loading Document".

NEXT, you should see where it says on top "READ THROUGH THE APP" and your application should be below it.

C

D

"Now go ahead and scroll all the way down to where it says "YOU ARE READY TO SIGN" and there should be a box under the paragraph that says "FULL NAME". Go ahead and type in your full name in the box and then click the button under it that says "SUBMIT".

After you click "SUBMIT" you should now see on the screen where it says "THANKS, WE'VE RECORDED YOUR SIGNATURE" with a thumbs up icon next to it."

E

END OF E-SIGNATURE GUIDE

1

2

-

FIRST, when the applicant is done signing, click on the "CONTINUE TO SUBMIT" button.

-

SECOND, click on the "SUBMIT APPLICATION" button.

-

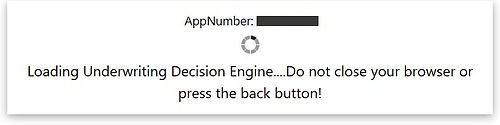

NEXT, you will see where it says "LOADING UNDERWRITING DECISION" followed by the underwriting decision.

-

The underwriting decision will either be approved as applied for, declined or, if you selected to receive a different plan if applicable, it may approve the applicant for a different rating in which the applicant will need to accept.

-

Click the "FINISH" button.

END OF EAPP