E-APP GUIDE

-

From your dashboard, click on "QUOTE & APPLY" at the top menu.

-

NEXT, click on "LAUNCH E-APP".

-

NEXT, click on "START APPLICATION".

-

NEXT, click on "FINAL EXPENSE EAPP".

1

2

-

FIRST, click "YES".

-

SECOND, click "NEXT".

1

2

3

4

-

FIRST, choose if this is a new application or a reinstatement of a Liberty Bankers Policy.

-

SECOND, enter YOUR birth year.

-

THIRD, enter the last four of YOUR social security number.

-

FOURTH, click "CLICK HERE".

3

1

1

2

-

FIRST, once you've populated your agent number in the colored box, copy your agent number and paste it in the field below.

-

SECOND, click "CLICK HERE"

-

THIRD, confirm your information then proceed with the rest of the section.

4

5

6

5

-

FOURTH, to keep it simple, try to keep the payor the same as owner, and more preferably the owner, payor and insured the same person if possible.

-

FIFTH, enter owner resident city / state.

-

SIXTH, click "NEXT".

-

FIRST, fill in the applicant's general information.

-

SECOND, click "RUN INSTANT ID".

-

THIRD, continue to fill in the applicant's information and physician / clinic's

-

FOURTH, click "NEXT".

1

2

1

3

4

1

2

-

FIRST, choose a signature method. TEXT is preferred if possible if the applicant is using a mobile phone.

-

SECOND, verify the applicant's number is correct, click "SEND AUTH" and then follow the E-Signature Guide to guide the applicant through the signature process.

E-SIGNATURE GUIDE

"Now [Applicant's Name], I'm going to send you a text message for signature real quick, and at the very end of the text, there will be a six digit code. I just need that six digit code number please"

END OF E-SIGNATURE GUIDE

-

FIRST, after receiving the authorization code from the appplicant, enter the code into the field below the button.

-

SECOND, complete the rest of the section with the applicant.

-

THIRD, click "NEXT"

1

3

2

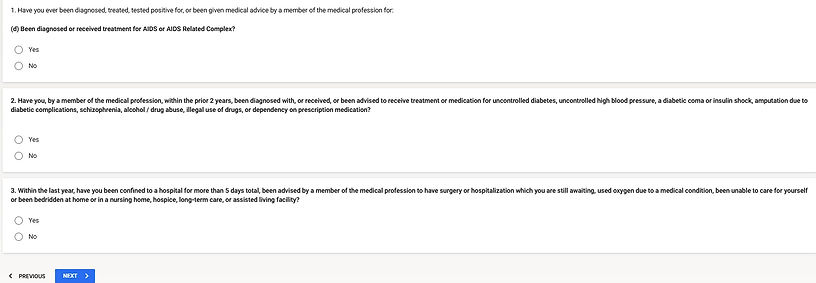

Health History Part 1

Health History Part 2

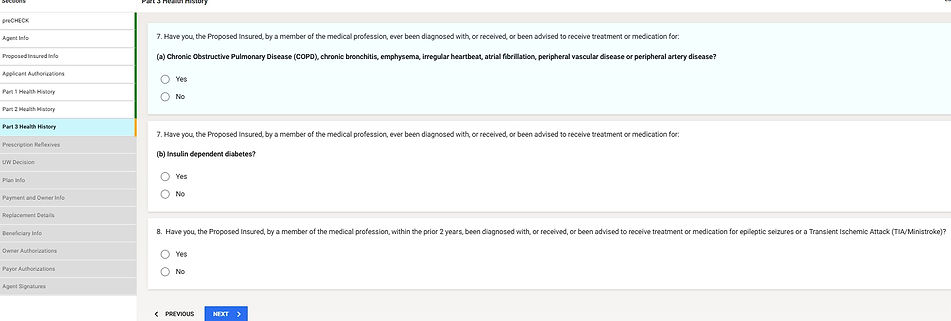

Health History Part 3

3

1

2

-

FIRST, if the applicant is taking any medications / prescriptions for conditions listed on the health history questionnaire, click "YES".

-

SECOND, enter the name of the medication in the blank field below and the medication name should populate to select. Do not enter more than one entry on the line at the same time.

-

THIRD, after entering all medications, click "NEXT"

1

2

-

FIRST, if the applicant is approved for the plan applied for, click "YES". For example, if the applicant is applying for the Preferred Level plan and it shows they are approved for the Preferred plan, click "YES". However, there will be times where the applicant is applying for Preferred, but they are approved at Standard or Modified. In this case, you will need to discuss the price or coverage difference and if they are OK with it, you can click "YES" to proceed. If not, click "NO", close the application and pivot to another carrier.

-

SECOND, click "NEXT"

1

2

3

4

6

5

-

FIRST, enter the coverage amount that the applicant is applying for.

-

SECOND, check any riders IF applicable. If none, leave blank. "ACCIDENTAL DEATH": Every policy already includes death due to an accident. However, the accidental death benefit rider doubles the coverage amount in case of an accidental death. For example, if a client has $20,000 in base coverage and they pass away of natural causes, their beneficiary will receive $20,000. If they pass due to an accidental death, the beneficiary will receive $40,000. "CHILD / GRANDCHILD RIDER": This rider allows the insured to insure their children / grandchildren under 18 for a limited amount of coverage. Coverage for the minor children expire upon their 22nd or 25th birthday. It is recommended that you do not add a child or grandchild rider if working with leads as there may be further underwriting needed on the children for their approval.

-

THIRD, to keep it simple, choose "MONTHLY".

-

FOURTH, if applicant wants their recurring payments to draft on a specific day of the month, click "NO". If they want it to match their social security deposit day, click "YES". For examply, every 2nd Wednesday of the month. Only select this if it makes sense to do so.

-

FIFTH, enter the recurring draft day.

-

SIXTH, click "NEXT".

1

2

-

FIRST, click "YES" as the carrier does not accept cards as a form of payment.

-

SECOND, choose if the applicant would like the coverage to begin and the first payment taken out immediately upon approval / issue OR if they need to set it for a different date or a date that matches their recurring.

-

THIRD, enter the applicant's bank account information.

3

8

4

5

5

6

7

7

-

FOURTH, click "YES".

-

FIFTH, click "RUN GVERIFY" button. After clicking the button, the brown box will turn teal and says that the information is processing or verfied.

-

SIXTH, select "OWNER"

-

SEVENTH, enter any current coverage or replacement questions.

-

EIGHTH, click "NEXT".

-

FIRST, choose a beneficiary type. To keep it simple, choose "PERSON" and then the applicant may change it later if needed.

2

1

2

3

4

5

-

SECOND, enter the primary beneficiary information. Address, Phone# and email may for beneficiary may NOT BE REQUIRED, but if they are, you may use the applicant's to finish the application. However, always attempt to get the beneficiary's phone# to call as a potential client.

-

THIRD, choose if the benefiary entered is a "PRIMARY" or "CONTINGENT". The first beneficiary entered must be a "Primary". A "Contingent" is a back up beneficiary if the primary cannot receive the death benefit. It is not mandatory and can be added later by the applicant. Beneficiary must be 18 years of age and over.

-

FOURTH, enter the percentage of the death benefit that each beneficiary will receive. If there are more than one beneficiary, the percentage with all combined must equal 100%. For example, if there are two, then the percentage for both should be something like 50/50 or 60/40. If three, 34/33/33. Same applies to Contingents.

-

If additional beneficiaries need to be added, click on "ADD" on the bottom right of the section.

-

FIFTH, click "NEXT".

-

FIRST, all of these questions must be answered "YES".

-

SECOND, answer according to your relation to the applicant.

-

THIRD, select "IN PERSON" only if you are physically with the applicant. Select "TELESALES" if done over the phone or virtually such as Zoom.

-

FOURTH, common answer would be "NO".

-

FIFTH, select "YES" as you are agreeing to sign electronically.

-

SIXTH, regarding agent split, if you are the only agent who will be receiving commissions on this application, select "NO". Select "YES" if you and another agent are splitting commissions on this application. Percentage split must equal 100% combined. For example 75/25, 50/50, 60/40.

-

SEVEN, click "SUBMIT".

1

1

1

1

2

3

4

5

6

7

END OF E-APP GUIDE